Resources

Discover the latest news, insight and opinions from Divido.

Explore and learn more about the retail finance industry, and start your journey to a bigger experience today.

Blogs

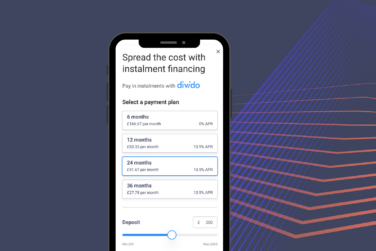

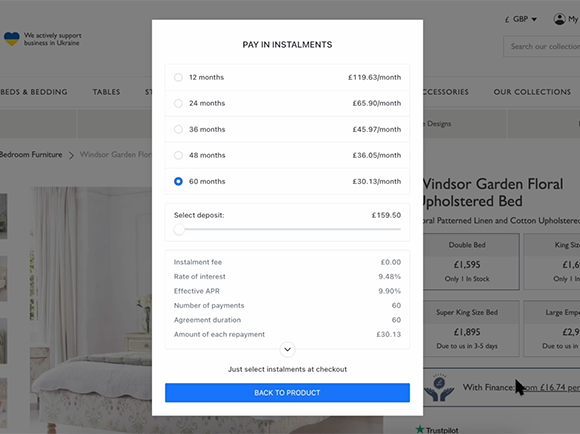

Dive deeper into the payments industry

News

Press Releases

Dive deeper into the payments industry

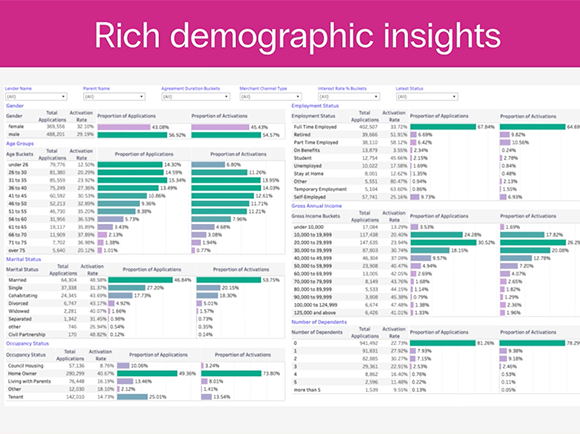

Whitepapers

Dive deeper into the payments industry

Webinars

Discover the latest trends from the world of retail finance

Videos

Discover the latest trends from the world of retail finance

Keen to know more?