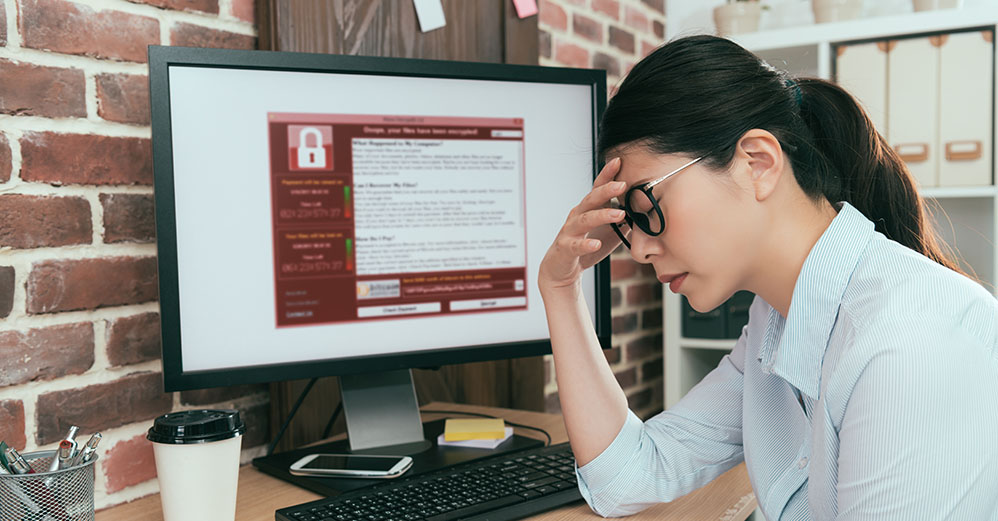

Divido Introduces Divido Security+: A Robust Solution to Fortify Retail Finance Against Escalating Cyber Threats

Written by Content Team

London, 12 February 2024 – In a landscape where the financial sector faces an increasing onslaught of global cyber incidents, Divido, the checkout finance platform expert, today takes a significant step to empower its clients with enhanced security measures.

According to IBM, the financial sector is second only to healthcare in bearing the brunt of cyber threats, with losses per incident amounting to £4.7 million in 2023. In response to the escalating risks, Divido is proud to announce the launch of Divido Security+, a comprehensive security solution designed to augment the existing ISO 27001 certified security provided by Divido. The new offering addresses emerging threats, particularly those associated with Artificial Intelligence-based (AI) attacks and phishing.

AI is identified by the UK’s National Cyber Security Centre (NCSC) as a looming threat that is likely to increase the volume and impact of cyber attacks over the next two years. Divido Security+ not only guards against AI threats but also aligns with NCSC’s recommendations for robust security measures to counteract renaissance (information gathering) and exfiltration (unauthorised transfer of information) tactics employed by state actors and commercial entities.

Highlighting the urgency of such measures, the NCSC points to instances like North Korea, a known bad actor that has illicitly obtained £1.6 billion in the last five years, showcasing a rapid advancement in AI, malware, and other capabilities.

Divido Security+ empowers banks, lenders, and merchants with real-time system monitoring and swift response capabilities, acting upon client feedback and insights from organisations like NCSC.

Key features of Divido Security+ include:

PROTECT – Rapid Detection and Response

Partnering with Forta’s Alert Logic, Divido ensures rapid identification, investigation, and escalation of suspicious and malicious activities within 15 minutes. This proactive approach prevents threat actors from reaching their objectives, safeguarding financial data and operations.

POLICE – Anti-Fraud Technology

Collaborating with TransUnion, Divido employs cutting-edge technology to identify suspicious users, devices, and transactions in the early stages, aiding in the prevention of fraudulent loan applications.

TEST: Advanced Penetration Testing

Partnering with a specialist CREST and CHECK accredited penetration testing agency, Divido conducts annual penetration tests on retail finance solutions. Divido Security+ customers receive comprehensive reports and details, ensuring a robust defence against potential vulnerabilities.

MONITOR: Platform & Security Visibility and Monitoring

Following NCSC recommendations, Divido Security+ provides clients with access to a dedicated platform status page, allowing real-time monitoring of endpoints and integration performance.

Alastair Jones, VP of Technical Operations at Divido, emphasises the significance of these advancements, stating, “Financial service providers are particularly at risk because they are responsible for vast amounts of sensitive data. In response to this, we developed Divido Security+ which enables retail finance providers to go above and beyond.”

In addition to Divido Security+, Divido already maintains a commitment to 100% security by default, encompassing Akamai firewall, secure development processes, CREST and CHECK certified penetration tests, and ISO 27001 certification.

For more information on Divido Security+ and how it can fortify your retail finance operations, please visit: www.divido.com

-ENDS-

Media Contact:

Please email: press@divido.com

About Divido:

Divido Financial Services Ltd. is a London-based financial services company.Divido connects lenders, merchants and consumers at points of sale across Europe to offer checkout finance solutions. Divido’s award-winning, whitelabel technology platform enables merchants to offer checkout finance online and in-store by connecting their customers to an ecosystem of Tier One lenders at the point of sale, all through a single API.

Divido was recognised by Deloitte in 2020 as one of the fastest-growing technology companies in the UK. In June 2021, Divido raised $30 million through Series B funding, led by investors HSBC and ING, to build out its market-leading platform. Divido was named one the top 50 fintech organisations in the UK in the 2022 TechRound FinTech50.

Keen to know more?