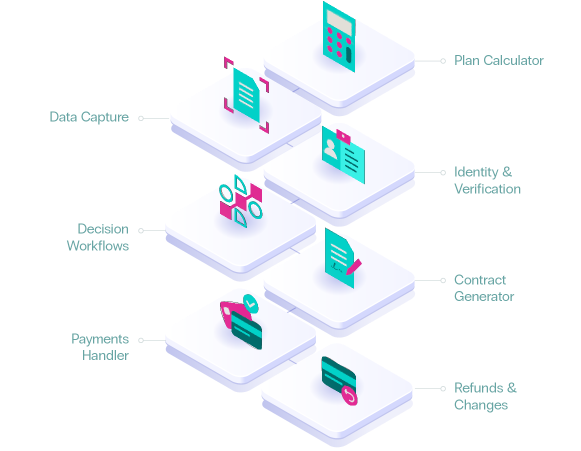

CONVERT: Application Journey

With our powerful modules we can quickly configure application journeys to your specifications. Divido connects to your back office systems and services from your third-party providers to deliver seamless consumer experiences.

1. Divido Calculator

Add the interactive calculator to any point of sale to show available finance plans and to adjust deposits. Merchants use a whitelabel calculator or build new designs with the Merchant API.

- Suitable for in-store, online and telesales

- Embed our standard calculator at any point of sale

- Design your own calculator using our Merchant API

2. Data capture

Divido manages the flow of fields that consumers are presented with to capture all required information. Our modular architecture makes it easy for lenders to make adjustments as needed, for example, to support policy changes.

- Data validation can include address, phone number, sort code and account number

- Automatically screen out consumers that do not meet basic requirements set by lenders

- Pre-populate fields with captured data for a better consumer experience

3. ID and verification

Collect all required identity data from consumers whilst managing a smooth consumer experience. Most commonly, Powered by Divido provides this data directly to lenders, though our platform can connect directly to third party services.

Solutions can capture applicant data through Divido ID&V integrations that can include:

- Liveliness test

- ID scanning

- Selfie photo

- And more…

4. Decision workflows

Lenders can usually make a near-instant decision on finance applications. Other times consumers may need to provide additional information. The decision workflows module easily handles all these situations without letting consumers fall through edge-case crack

- Email or text reminders for deferred decisions keep consumers informed

- Additional documentation request email templates

- Secure upload links for consumers to share documentation

- All managed on Divido Lender Portal

5. Contract generator

After the lender has accepted an application, the contract generator pulls together the plan details and consumer information. Contracts are created according to the lender’s template.

- Lenders can choose how contracts are displayed to consumers

- Consumers can easily sign contracts digitally, using any device

- Divido sends lenders and consumers a copy once signed

- Divido can simply redirect consumers to the lender for contracting if needed

6. Payments handler

Paying deposits is made easy with Powered by Divido. For in-store and online payments Divido collects deposits and ensures merchants receive the funds directly. Powered by Divido also gives merchants the flexibility to collect deposits however they prefer, using their regular payment processes, including cash payments.

7. Refunds and changes

Powered by Divido makes it seamless for merchants to cancel finance applications and request refunds from lenders. They can do this using either a Merchant API integration into their Order Management System or manually initiate changes using the Divido Merchant Portal.

- Manage requests using the Lender Portal

- Send secure messages to merchants and change the application status

- Lenders spend less time managing applications with automated consumer journeys

- Handle complex edge-case scenarios, such as a consumer refusing to accept the quality of a product installation.

Ready to build bigger, better experiences?

You might also

be interested in: