We delved deep into the shopping habits of nearly 2,000 UK consumers to uncover the opportunities for merchants and lenders. Here’s what we found.

Gone are the days when retail finance was perceived as a niche payment option. We find the majority of UK consumers are open to using it; seven in ten (70.3%) of our respondents said they are either intending to, or may use checkout finance to make a purchase in the next 12 months.

What’s particularly interesting is that nearly everyone (95%) who had used checkout finance in the past was open to using it again.

While young people are the most likely to use checkout finance, seven in ten 31 -45 year olds, and six in ten 46 – 60 year olds had made a purchase in the last three years. Older consumers – those aged 61 and above – are more sceptical, though four in ten still agree that it can help to manage their finances (40%) and feel comfortable paying with it (37%).

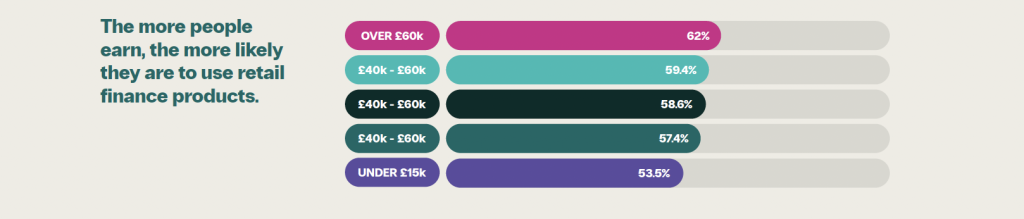

We also found the more people earn, the more they use retail finance. This makes intuitive sense; those with more disposable income can afford more, so they borrow more to finance bigger purchases.

We also find women are 30% more likely to shop with checkout finance than men, and most of these purchases are made in the fashion and beauty sector.

In fact, the biggest opportunities for retail finance are fashion and beauty, furniture and homeware, electronics, and white goods.

These are all industries that require thoughtful, experiential purchases. Consumers like to touch and feel these items before buying.

Interestingly, there also appears to be a North-South divide: people in Wales and the North of England are more likely to use retail finance.

You might also

be interested in

Keen to know more?