Hunt’s Budget to Stop “Struggling Households” Using BNPL Apps for Essentials?

Written by Jonathan Axup

Jeremy Hunt, Chancellor of the Exchequer, today unveiled the UK Government’s 2024 budget. With public sector debt standing at a whopping 91.7% of GDP – its highest since the Second World War, Hunt labelled this a debt busting budget with a pledge to reduce new borrowing to less than 3% of GDP. This of course means the public debt burden will continue to increase, just at a slower pace.

But what of consumer debt? Was there anything in the budget to aid struggling households falling into debt?

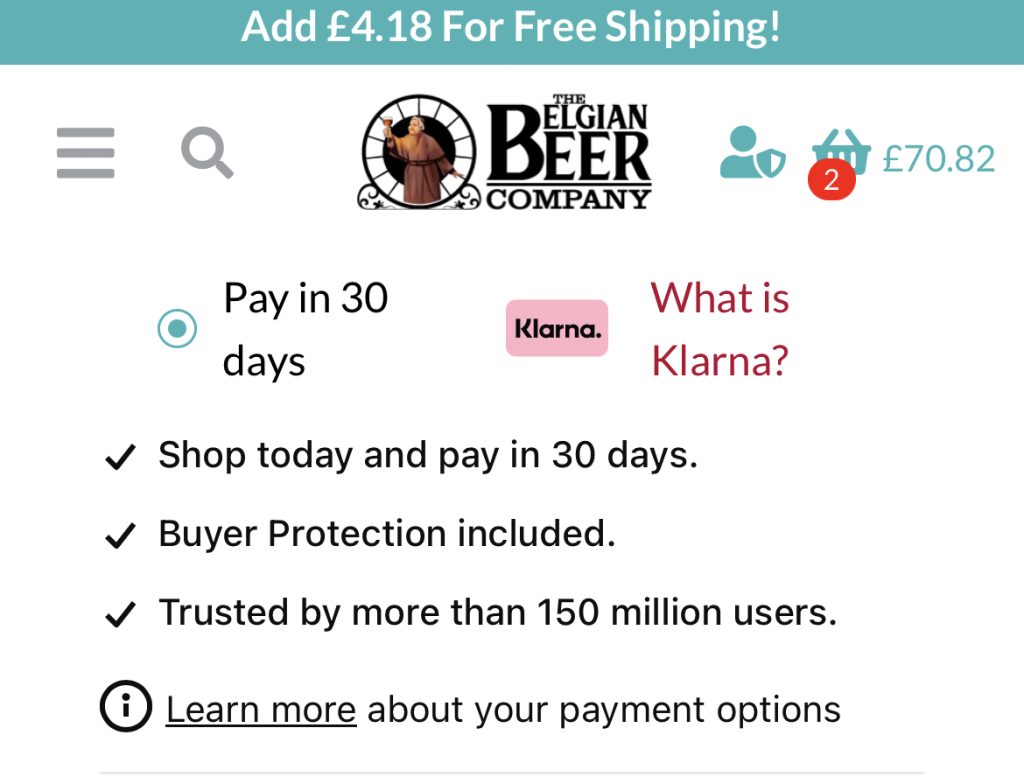

Debt charity StepChange is particularly vocal against “unregulated” Buy Now, Pay Later (BNPL) apps. It said, “There is rising evidence that BNPL isn’t just being used to buy discretionary items like fashion, but also life’s essentials like groceries.” The image below is perhaps clear evidence of this. It shows beer companies asking households to drink now, pay later with Klarna.

For struggling families Hunt announced a six-month extension to the Household Support Fund. This scheme, funded by the Department of Work and Pensions, has already given nearly nine million grants to struggling households to cover basics including food, essential items and energy bills. An extension to this scheme can help provide support where families may have turned to unregulated BNPL apps to cover the shortfall.

In another positive note for tackling bad debt, Hunt has eliminated the £90 fee to apply for a Debt Relief Order, a scheme that helps low-income families who fall into debt of less than £30,000.

For the average person on the street, newspapers estimate that households could be around £500 a year better off from the 2p National Insurance cut and freezes on fuel and alcohol duties. That’s good news for consumers looking to pay down debt, or simply save up for a deposit to replace an aging sofa.

After the UK unsurprisingly fell into recession in the second half of 2023, there’s now optimism that the UK will gradually resume its GDP growth, with the Office for Budget Responsibility predicting 0.8% growth in 2024, and 1.9% the year after. A return to economic growth would enable the government to pull the reins in on national debt and hopefully it will also give consumers the economic footing they need to manage their finances responsibly.

You might also

be interested in

Keen to know more?