Divido Calculator upgrade: new look and enhanced functionality

A finance calculator is an essential part of the checkout finance journey, whether that’s online or in-store. It’s a key part of the discovery for consumers, where they can see what finance plans are available for their basket size, country and product purchase. A best-in-class finance calculator can increase conversions and average order values.

So, with that in mind, we’ve made some enhancements to the Divido Calculator to ensure consumers can effortlessly checkout with retail finance. The upgraded calculator is available to merchants on Divido Connect and to lenders on Powered by Divido.

What’s changed?

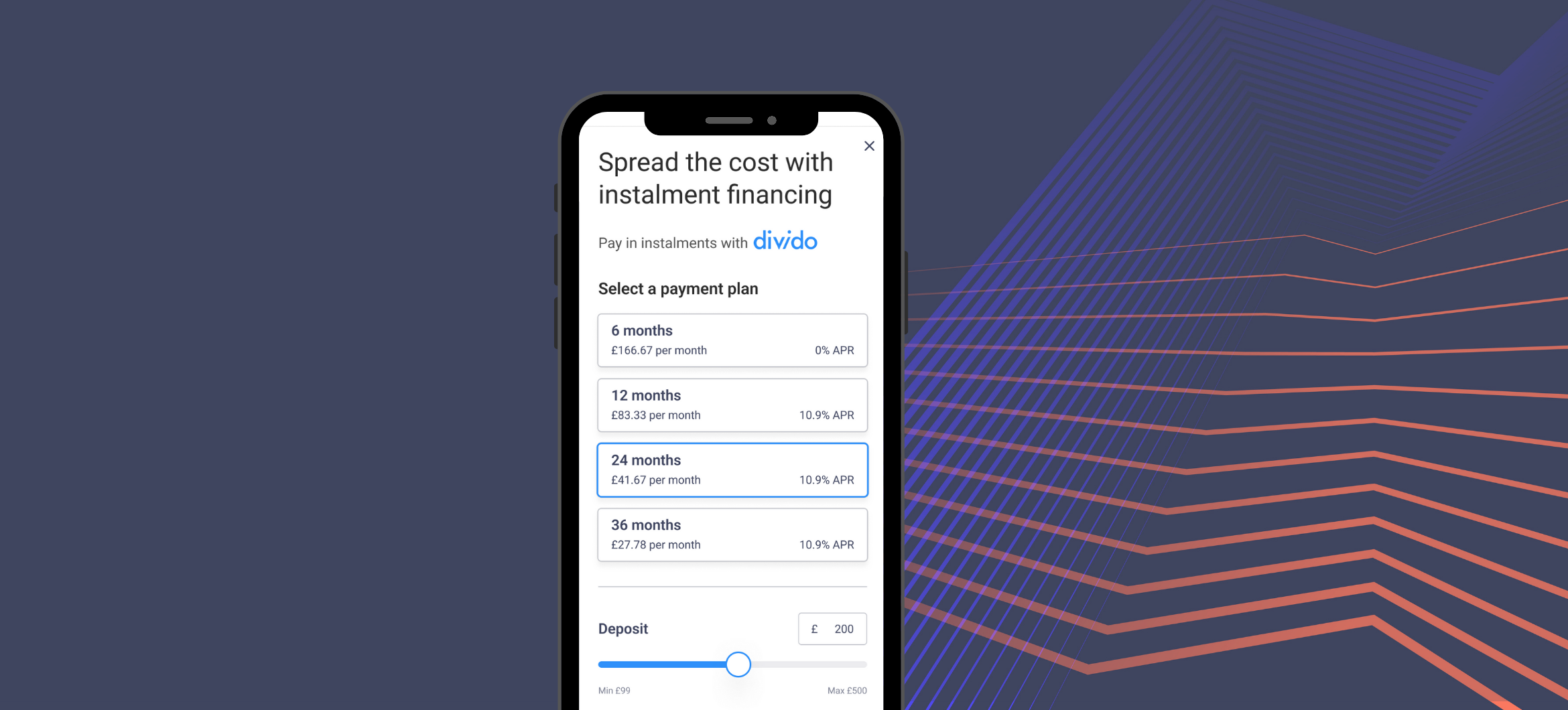

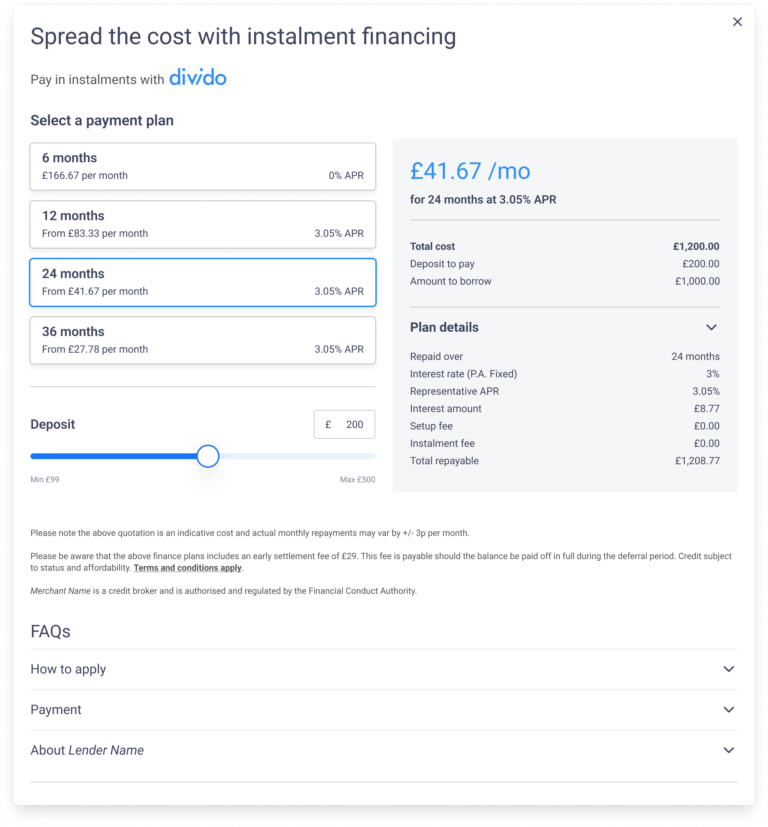

More whitelabel options and improved design – we’ve modernised the user interface and redefined design elements so that it is more responsive across all devices.

The enhanced calculator gives lenders more control over elements like colours and fonts to keep their brands at the forefront. Lenders can also more easily offer whitelabel capabilities to their large merchant customers.

We’ve also improved the layout so that key elements of the finance plans are in view to ensure consumers can make informed decisions.

Enhanced functionality – we’ve made some tweaks to the backend to make it quicker and easier for lenders to customise the calculator. The template is more configurable, and changes can be made via the API without involvement of engineers.

A tool to boost conversions

The Divido Calculator can be embedded wherever you want to start taking payment for products with retail finance. Whether that be on product pages or at the checkout, consumers can see how affordable a product can be when paid with finance.

It is also dynamic. It takes the cost of goods as an input, enables the customer to select a deposit amount, and then shows which finance options are available – indicating the monthly repayment amount for each one. Consumers can interact with the calculator and toggle between different deposits to find a plan that suits them.

Powered by Divido lenders can offer merchants plenty of flexibility over how they promote finance to grow their bottomline. Merchants can offer interest free finance plans on higher margin products or to clear excess stock, and can make finance available only on certain basket sizes, sales channels and product types. All of this impacts what plans customers see in the calculator.

The calculator is omnichannel. It can be embedded into merchant websites or used by sales staff in-store or over the phone through the Divido Merchant Portal. Available via API and ecommerce plugins, we’ve made it simple for merchants to embed this into any point of sale.

By combining a user-friendly interface, advanced functionality, and branding customisation, you can increase conversions and build better experiences for consumers at the checkout.

Ready to elevate your checkout finance offering? Get in touch.

You might also

be interested in

Keen to know more?