Divido response to FCA intervention on PayPal and QVC BNPL contract terms

Written by Marketing Team

Todd Latham, CEO, Divido said:

“It’s unsustainable for the FCA to have to dip into contract terms ad hoc, this is exactly the reason we need a properly regulated sector.

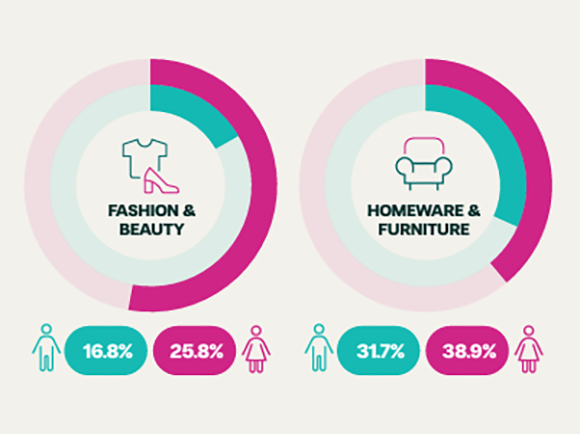

“As the FCA acknowledges, retail finance applied appropriately can be a powerful budgeting tool. In our latest research, eight in 10 checkout finance users said it has helped them manage their finances better.

“We’re urging the Government to keep their regulatory plans alive, and not give up because of pressure from a few bad actors. Regulation is vital to offer consumers a safety net from unscrupulous BNPL firms. Firms that lack consideration for their customers’ affordability.

“As we ramp up to Christmas, strained consumers deserve to know that the financial products they’re being offered are relevant and proportional to their needs. It’s time to turn the spotlight on BNPL, not flick off the switch.”

ENDS

###

Notes to editors

For more information, please contact:

The Divido marketing team at marketing@divido.com

About Divido

- Divido connects merchants, lenders and payment partners at points of sale across Europe to offer checkout finance solutions.

- Divido offers merchants access to retail finance across multiple markets with one integration, or to whitelabel its tech stack to help merchants launch their own services.

- Through Divido, consumers can instantly access finance from established lenders at the moment they need it, online, in-store and on the go.

- Divido is fully ISO 27001 certified.

- Divido has received The Queen’s Award for Enterprise, and Deloitte included Divido in its 50 Fastest Growing Technology Companies in the UK.

- Headquartered in London, the business employs over 70 people.

- Find out more at https://www.divido.com/

You might also

be interested in

Keen to know more?