Merchants can now offer tailored finance plans through Divido’s Finance Matcher

Traditionally, consumers only get one shot at choosing the right finance option. They pick a finance plan to buy a product, then the lender decides if the monthly payment amount is affordable or not.

Some lenders simply decline consumers who set monthly payment amounts above what they can afford. But this approach can be a thorn in the side of merchants who see good customers turned away because they chose the wrong finance plan.

What if, with a bit of intelligence, merchants could accept more sales without any compromise to customer care and affordability standards?

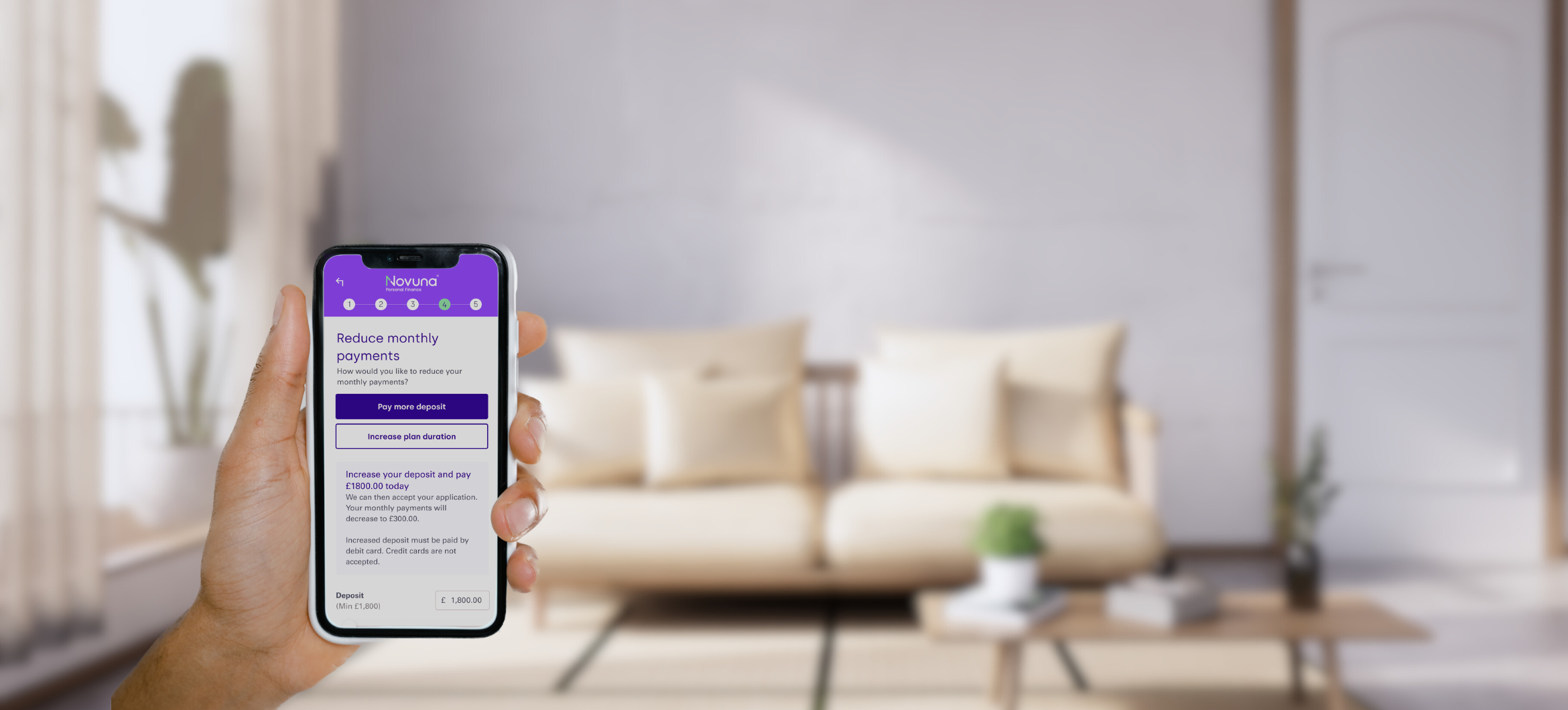

From July, merchants using Divido can offer their customers Finance Matcher. With this new feature enabled by Novuna, customers go through a soft credit check and can be matched with finance plans they can afford (if there’s a plan they can afford). For example, switching to a 24-month interest free plan from a 12- month plan halves monthly repayment amounts.

To maintain responsible lending standards, consumers who were soft declined for their first choice of plan will never be offered an alternative with more interest to pay.

This may sound like a no-brainer but no other finance provider in the UK offers this feature because it requires a deep customer understanding and a modern tech stack. Some lenders promote ‘waterfalling’ and ‘subprime’ lending, which unfortunately means ‘riskier’ customers are charged higher interest rates. This is obviously a no-go for merchants who care about their customers’ financial wellbeing.

Finance Matcher even improves the payment experience for customers who would have been accepted for their chosen finance plan. After a soft credit check, Finance Matcher can explain to customers why other finance plans may better fit their financial circumstances, such as plans that are faster to pay off.

Finance Matcher is available to all Divido merchants in the UK with Novuna, subject to approval, and is available for consumer purchases in-store, online and by telesales.

You might also

be interested in

Keen to know more?